CONSUMPTION DOWN, STEEL ENTERPRISES ADDED PRESSURE FROM RAW MATERIAL PRICE RETURNED HIGH

Consumption decreased, steel enterprises added pressure from raw material prices back to record levels

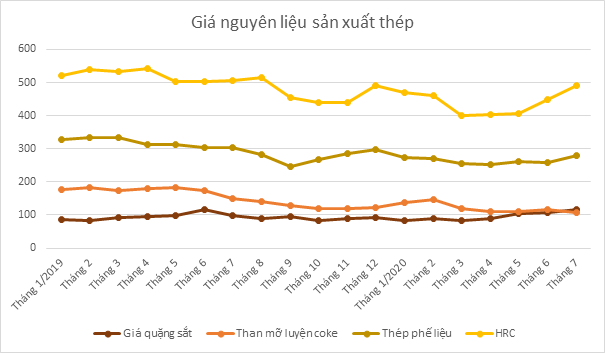

Prices of iron ore and HR coil surged again

According to a report of the Vietnam Steel Association (VSA), after many months of falling steel production material prices, in May, June and July it rose again. In particular, the price of iron ore on 8/8 was traded at 115-118 USD / ton, up 9-12 USD / ton compared to the beginning of July and 30 USD from the beginning of May. At the same time, the price of this material also reached a level equivalent to the record high prices recorded in July 2019 due to the dam failure at the Vale mine (Brazil).

Scrap price also increased from 251 USD / ton in May to 280 USD / ton at the beginning of August. The price of hot rolled coil (HRC) CFR at East Asia port increased strongly in recent 2 months to 450 USD / ton and 490 USD / ton, is approaching the level of 500 USD / ton in the same period last year. HRC CFR price at East Asia port recorded the highest level of about 620 USD / ton in early March 2018.

Beginning in May, HRC prices in China have also increased steadily from 3,460 yuan (RMB) per ton to 4,072 yuan as of August 13.

Data from the China General Department of Customs showed that the country imported 112.65 million tons of iron ore in July, up 10.8% from June and 24% year-on-year. Generally, in seven months, China imported 659.6 million tons of iron ore, up 11.8% from the same period last year. According to the Wall Street Journal, iron ore prices soared due to China's economic recovery after Beijing. implementing a series of stimulus measures, focusing on infrastructure and construction projects.

The high rise in raw material prices put pressure on the profits of steel enterprises in the context of a challenging recovery momentum due to the re-outbreak of Covid-19.

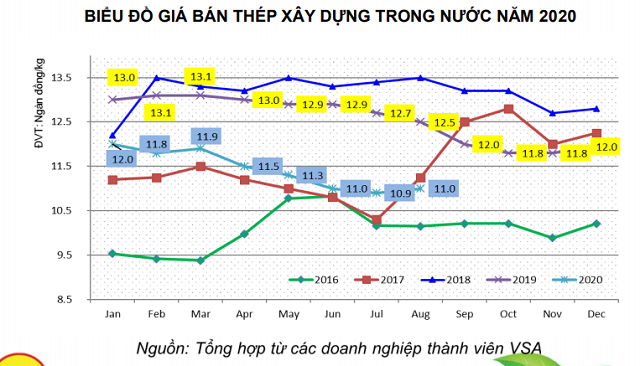

According to the VSA report, although the raw material prices for steel production fluctuate in an upward trend, the average domestic steel selling price in July is about 10,900-11,000 VND / kg depending on types and enterprises, down from months before. Competition between factories to keep or develop more market share is still fierce, especially in the South, in both the civil and construction sectors.

Iron ore is the main raw material for construction steel production of Hoa Phat Group (HoSE: HPG). With the high movement of iron ore prices but the price of construction steel does not increase but also decrease, it could make the profit margin of the corporation go down. In 2019, after a dam failure at the Vale mine (Brazil) took place in January, iron ore prices continued to rise and peaked in early July, which resulted in net profit margins in the manufacturing and trading sectors. Hoa Phat steel fell sharply to 9.1% and 6.86%, respectively. By the first and second quarter of this year, Hoa Phat steel segment's net profit margin increased again when raw material prices fell.

With Hoa Sen Group (HoSE: HSG), the production process starts with the main raw material, which is hot rolled steel (HRC), creating cold rolled steel and going to the final product of corrugated iron. Therefore, the increase in HRC price in the last 2 months may affect profit margin. In the first half of 2019, when the price of HRC anchored at a high level of over 500 USD / ton, the gross profit margin of the group was only 11.3% and 13.4%. In the first half of this year, the price of HRC gradually decreased to 400 USD / ton, pushing HSG's gross profit margin up to 17.3% and 14.7%.

Steel consumption in the first half of the year decreased, entering the rainy season

According to VSA, production and sales of domestic steel products in the first 7 months recorded negative growth. Specifically, steel production of all kinds reached 13.7 million tons, down 6.9% over the same period in 2019; sales reached 12.37 tons, down 9.6% and exports reached 2.2 tons, down 19.3%.

The VSA report stated that the global steel market hopes to be better in the third quarter, but the second Covid-19 outbreak shows challenges. The export market is quite difficult due to countries in a closed phase, ongoing supply chain disruptions and competitive raw materials.

In Vietnam, steel consumption has prospered in the post-gap period in April but continues to face difficulties due to the complicated situation of Covid-19 epidemic and slow consumption due to the rainy season. However, the bright spot is that the Government is promoting public investment to increase demand.

Steel companies' semi-annual results reported a drop in revenue, with the exception of Hoa Phat. Specifically, Hoa Phat recorded sales of steel sold out to reach 32,943 billion, up 38%.

While total sales volume of VSA member units decreased, Hoa Phat construction steel output still increased 14.5% in the first 7 months to reach 1.81 million tons. In particular, the output of finished steel for export also increased by 73.3% to 256,500 tons, recording the equivalent of the export volume of the whole year 2019. Along with that, Hoa Phat also supplied to the market 1 million tons of steel billet. in the first 7 months of the year.

In contrast, other steel companies such as Hoa Sen, Nam Kim, SMC, Pomina all reduced revenue from 11% to 13%, even some businesses decreased 42% of revenue, namely Dai Thien Loc.

In terms of profit, Hoa Phat, Hoa Sen and Nam Kim are profit growth units. In contrast, Pomina had a bold loss of 144 billion dong in the first half of the year, higher than the 132 billion dong loss in the same period last year.

In addition to the flourishing steel business, Hoa Phat also contributed significantly to the profit growth of the sudden agricultural segment. The agricultural segment brought Hoa Phat 841 billion dong of profit after tax, while the same period last year was only 109 billion dong.

Although Hoa Sen Group's revenue decreased, COGS dropped deeper, gross profit margin improved significantly and financial expense decreased, helping net profit to reach 520 billion dong in the first half, up 140%.

For the second quarter alone, Ton Nam Kim's profit dropped sharply because the same period last year there was another 180 billion dong profit from the transfer activities. However, accumulated 6 months, corporate profits still increased 73% to 59 billion VND because the first quarter of the previous year had a net loss of 102 billion VND (the fourth quarter of 2018 and the first quarter of 2019 were the business period of Nam Kim. to the bottom, there appeared losses of more than hundred billion dong).

With Pomina lower revenue and high financial expenses of over 200 billion in the first half of the year, higher than gross profit resulted in a net loss of 144 billion dong.

The company said that due to the implementation of the blast furnace project, it is expected that it will just start operation in October, so interest expenses increase compared to the same period last year. Meanwhile, company revenue decreased due to lower industry consumption.

Source: NDH