US-China Steel Trade Conflicts: What are the impacts?

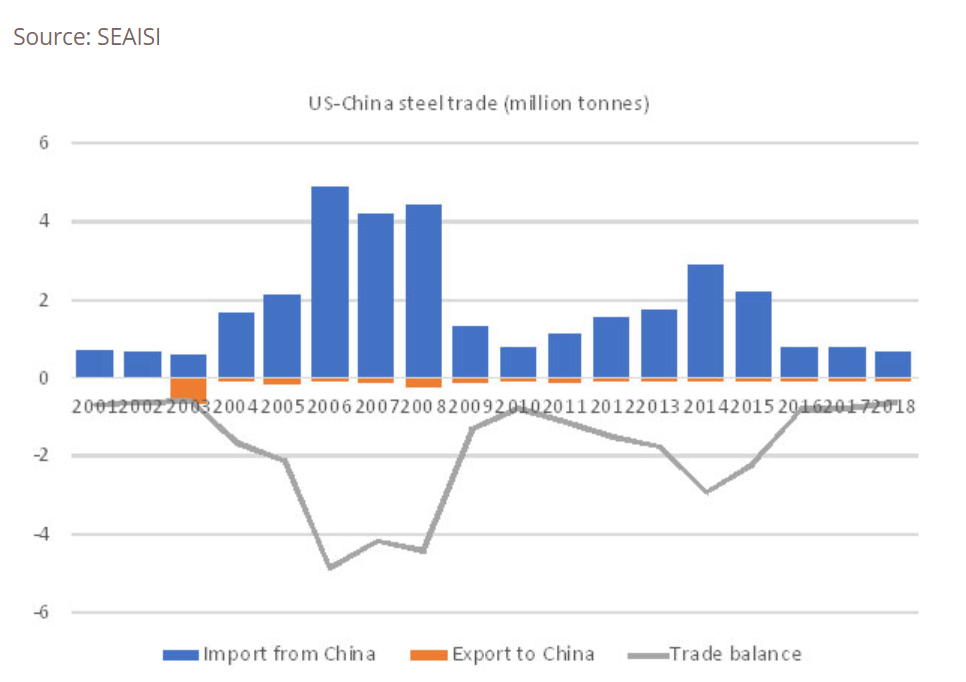

The US has been running steel trade deficit with China for some years. Net steel export from China to the US rose to nearly 5 million tonnes in 2006. Apart from China, other major steel trading partners for the US were Japan, South Korea, Germany, Turkey, Taiwan and Vietnam.

Following the imposition of Section 232 tariffs in March 2018, US steel imports declined by 3.5 million tonnes in 2018. Import from all major trade partners showed significant decreases in 2018. Finished steel import from South Korea declined by nearly a million tonnes to 2.5 million tonnes in 2018 and continued to drop to half of the previous volume from January to March 2019.

Import from Japan dropped slightly, by 100,000 tonnes to 1.3 million tonnes in 2018 and continued to declined to half of the previous volume in the first quarter of 2019. Import from Germany dropped slightly to 1.2 million tonnes and the volume continued to decline 23% y-o-y to 284,841 tonnes in the first quarter of 2019.

Import from Turkey contracted by nearly a million tonnes to 1.1 million tonnes in 2018. The import volume continued to drop to one-fourth of the previous volume in the first quarter of 2018.

Import from Taiwan dropped 14% y-o-y to nearly a million tonnes in 2018 and the import volume continued to decline at the same rate to 106,000 tonnes in the first quarter of 2019.

Import from Vietnam had been minimum prior to 2011 but the volume started to surge to above 100,000 tonnes in 2011 and continued to increase to reach a million tonnes in 2018. The bulk of the import was cold rolled coil and coated sheet. US’s import of coated sheet from Vietnam doubled in volume to 512,803 tonnes in 2018 and the volume continued to increase 12% y-o-y to 84,030 tonnes in the first quarter of 2019.

The US’s steel import from China started to declined significantly in 2016. Import volume contracted from 1.3 million tonnes in 2015 to 809,480 tonnes in 2016 and continued to decline to 650,408 tonnes in 2018.

On China’s side, according to CISA, there was no direct impact of US Section 232 action on China’s steel trade while there was more impact on processing and fabricating industry. Based on the forecast which was officially published by China Metallurgical Industry Planning and Research Institute, steel demand in China in 2019 will be 800 million tonnes, a decline of 2.4% y-o-y, and production is also expected to drop by 2.5% y-o-y.

China’s total finished steel export dropped marginally, by 8% y-o-y in 2018. On the other hand, China’s steel export to ASEAN increased 2-3% y-o-y in the same period and the export volume continued to increase marginally, by 1% y-o-y to 6.8 million tonnes in the first four months of 2019. China’s export of long steel to ASEAN declined while export of flat steel increased, especially export of coated sheet.

In general, after the imposition of trade measures from the US, Chinese companies may face more competition for their products as a result of higher prices of Chinese-made goods. The impact on ASEAN could be a potential trade diversion of cheaper Chinese-made goods into the region.

It is also expected that there could be some relocation of manufacturing facilities from China to ASEAN such as machinery, motors and production equipment. On the other hand, ASEAN suppliers could be negatively impacted from the reduced China demand or disposal of cheaper goods from China.